Imagine riding a rollercoaster that shapes the landscape of cities and neighborhoods; that rollercoaster is the real estate cycle. Understanding these phases is like having a roadmap for when to invest, when to hold, and when to prepare for shifts in the market. You’re in for a thrilling journey through Recovery, Expansion, Hyper Supply, and Recession – each with its own set of challenges and opportunities.

- Recovery – Let’s just pick Recovery to start the ride. It’s a time of cautious optimism. Vacancies start to decrease, and rental rates stabilize. As an investor or a prospective homebuyer, this is your cue. The market is warming up, and the best deals can be found here, before everyone else catches on. Think of it as finding that perfect hidden gem in a vintage store before it becomes everyone’s favorite haunt.

- Expansion – Next comes Expansion. This is when the party gets into full swing! Construction is on the rise, jobs increase, and the economy looks rosy. Beware, though—it’s easy to get carried away by the exuberance. This is when you get to see investments start to really pay off. Imagine the excitement when the property you picked up in the Recovery phase starts appreciating in value!

- Hyper Supply – Then, there’s Hyper Supply. The market is buzzing, maybe a little too much. Supply begins to outpace demand, and warning signs appear. It’s similar to when you hear a hit song so often that you sense it’s about to tip from everyone’s favorite to yesterday’s news. Here’s where you need to pay close attention, adjusting your strategy and preparing for what’s next.

- Recession – Finally, we hit Recession. The music stops, the economy slows, and it feels like the game of musical chairs has ended without a warning. But fear not, this is not the end, but rather a crucial part of the cycle. It’s a period to learn, to reassess, and to set the stage for the next wave of recovery. Think of it as the seeds of opportunity being planted under the snow of winter, waiting to sprout in the spring.

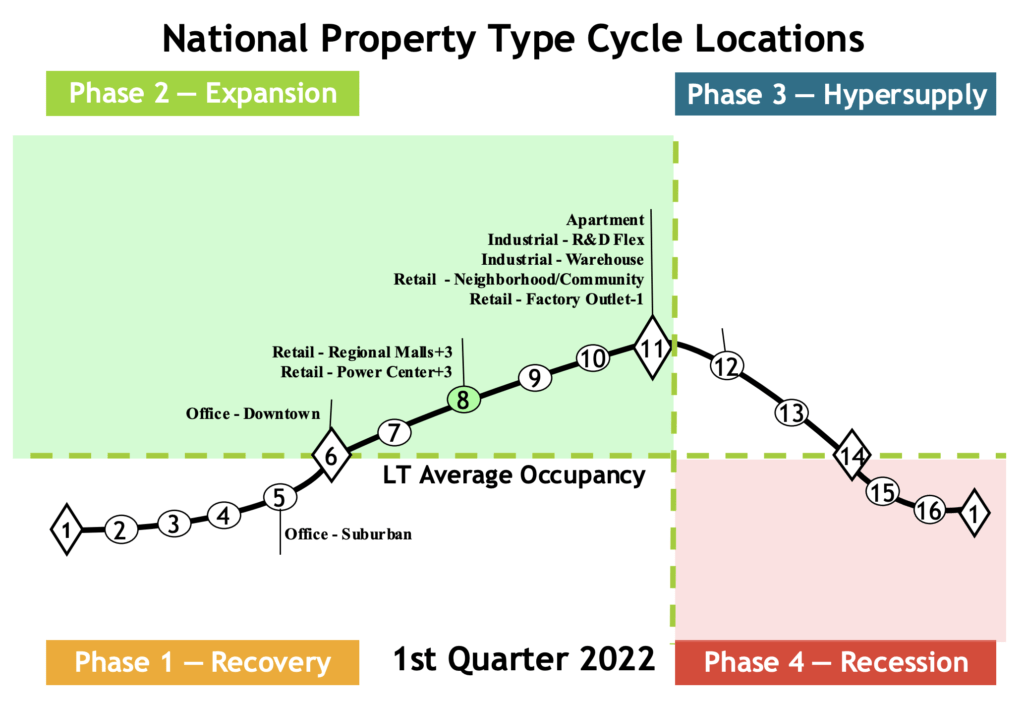

Each phase flows into the next, creating a continuous wave that savvy individuals like you can ride to success. With insights from experts like Dr. Glenn Mueller, you are now equipped to navigate these waters with confidence.

How It Affects Investors and Homebuyers

Now, let’s dive into how these phases personally affect you as an investor or homebuyer.

- Recovery – During Recovery, your ability to spot potential can secure a strong entry point into the market. By doing so, you’re setting the stage for future gains. Imagine having the foresight to invest in a quaint neighborhood just before it becomes the next big hotspot.

- Expansion – As Expansion takes hold, the value of your investments can rise significantly. You’ll feel the exhilaration of watching the worth of your property soar as demand surges. This is when smart decisions pay off and you can celebrate the growth you’ve anticipated.

- Hyper Supply – Hyper Supply is your cue for caution. It’s the phase where you should be extra vigilant with your investments, ensuring that you’re not over-leveraged and are prepared for a shift. It’s akin to sensing an impending storm and battening down the hatches of your financial portfolio.

- Recession – And finally, the Recession phase – though daunting – brings its own unique advantages. Prices soften, and although it may seem counterintuitive, it can be the perfect time to buy. For the brave at heart, there are deals to be had. It’s an opportunity to acquire assets at a favorable cost basis, setting you up for the next progression of growth.

With the rollercoaster of the real estate cycle mapped out before you, you are more than ready to ride the highs and lows like a pro. Enjoy the journey, and remember, with every dip comes the rise that follows!

Table of Contents

Market Cycle 01 – Recovery Phase

Characteristics of the Recovery Phase

Imagine that the storm has passed – the downturn is over, and now, you’re stepping into the light of new beginnings. That’s exactly what the recovery phase feels like in the real estate cycle. It’s your starting line. In this phase, occupancy rates might still be below average, and rents are not yet rising. But here’s the kicker – it’s also when you’ll notice the savvy investors begin to take action.

They see beyond the present; they spot the potential before the crowd does. Vacancies start to fill up slowly, but surely, as the economy stabilizes. You won’t see massive construction projects just yet, as it’s still too early for builders to commit. But the groundwork is being laid for future prosperity. The market is quietly healing itself, and this is the golden hour for those who can read the subtle signs of an awakening giant.

Opportunities During Recovery

Are you ready to ride the wave before it crests? During the recovery phase, your chance to capture value is prime. This is where you roll up your sleeves and scour the market for diamonds in the rough. It’s the period where properties may be acquired at prices that are still reflective of a recent recession, meaning potential for significant growth.

And guess what? You’re not competing with the whole world yet. The competition hasn’t fully caught on, giving you a clearer playing field to grab those opportunities. It’s the perfect time to negotiate favorable deals with less pressure and more room for creativity.

With insights from experts like Dr. Glenn Mueller, you can approach this phase with confidence. You’re not just guessing; you’re strategically positioning yourself to take advantage of the upward trend that’s bound to follow. And as you lock in those strategic investments, you can practically hear the market’s engines starting to rev up.

Let the thrill of the hunt energize you. The recovery phase is your invest-and-prepare moment. So, get ready to pave the way for the expansion phase, because, with the right moves, you could be at the forefront of the next real estate wave. Keep in mind that every real estate mogul started somewhere, and often, it was during the silent rumble of the recovery phase. Now, let’s dive into the market with eyes wide open, ready to spot those burgeoning opportunities that are just waiting for a keen investor to unearth them.

Market Cycle 02 – Expansion Phase

Signs of the Expansion Phase

Picture this:

You’ve made some savvy moves during the recovery phase, and now the scene around you is starting to change. The energy is electric as the real estate market enters the expansion phase.

It’s like watching a flower bloom – everything’s growing and full of color. Occupancy rates? They’re climbing higher than a kite on a windy day. New construction? It’s popping up like mushrooms after a rainstorm.

You’re walking down the street, and what do you see? Cranes towering over buildings, as developers are racing to keep up with increasing demand. It’s not just a signal; it’s a blaring horn telling you that the market is heating up, and you, my friend, are right in the middle of it.

You see, as things expand, rents start to surge, and properties you invested in during the recovery might now be in high demand. Investors and renters alike are flocking to the market, trying to get their piece of the pie. But you’re already there, ahead of the crowd, witnessing the growth firsthand and reaping the benefits of your early investments.

Strategies for Maximizing Gains in Expansion

Listen up, because now’s the time to really roll the dice. In the expansion phase, you can shine like a diamond as you fine-tune your strategies to maximize gains. This means being selective and focusing on quality over quantity. Not just any deal will do; hone in on properties with the best prospects for further rent increases or those in hot, up-and-coming areas.

You might even consider selling some assets that have hit their peak to reinvest in new opportunities with more room for growth. Think of it as playing chess – every move counts, and if you play it right, you can end up as the king (or queen) of the board.

With the market bustling, it’s also a prime time to leverage your assets. Refinancing to free up equity? That’s a smart play that can give you the firepower to chase after bigger, more lucrative deals. The goal is to build on your momentum and push your portfolio forward.

Remember, while the expansion phase is exhilarating, it’s not the Wild West. You’ve got to keep your head cool and make decisions based on solid data and expert insight, not just the thrill of the chase. But if you keep your wits about you and stay vigilant, the expansion phase can be like your very own financial carnival, where the rides are just as thrilling, and every game you play can win you a prize.

So as the market swells and blooms, keep your eyes peeled for those unique opportunities that scream potential. This ride is one for the bold – and guess what? You’ve got a front-row seat.

Market Cycle 03 – Hyper Supply Phase

Indicators of Hyper Supply

As you step into the hyper supply phase, feel your pulse quicken. You’re riding the high tide now, but look out! This is where the market can get ahead of itself. Observation is key here. You’ll start to notice an uptick in construction – cranes stretch across the skyline, setting the stage for a glut of new properties.

You see, this is when the market might just overshoot the demand. Occupancy rates may still be high, but they aren’t rising as fast anymore, and you’ve got that tickling sense at the back of your mind: something’s off. Rents plateau, and then you see it – the dreaded first sign of vacancies not filling as quickly.

It’s thrilling and nerve-wracking, but you, as an investor, are here for it. You’re watching those indicators like a hawk. As construction projects continue to complete, you’re calculating, pondering, “Is it time to hold, or time to fold?” But you’re not scared, you’re excited because you know that understanding the hyper supply phase is vital to stay ahead.

Mitigating Risks in the Hyper Supply Phase

Now’s the time to gear up with strategies to mitigate risks. Remember, timing is everything. You’ve learned from experts like Dr. Glenn Mueller, and you’ve got your finger on the market’s pulse. You can see when the wave is close to breaking, and you’re ready to ride it out or paddle back to shore with your gains.

You might strategize to sell off some assets at their peak before the market tips into recession. Or you could secure long-term, favorable financing to cushion against any potential downturn. Diversification is your friend here, keeping you afloat if certain segments see a downturn.

And let’s not forget about lease strategies – locking in tenants with long-term leases can secure your cash flow, ensuring your real estate investments remain solid. Negotiation becomes your playground as you seek terms that provide security amidst the brewing over-supply storm.

Feel that? The adrenaline of facing down a challenge and coming out ahead. You’ve made smart plays before, and you’ll do it again, because you’re not just in the game, you’re changing it. You’ve become one of those investors who not only survives the hyper supply phase but thrives within it, using foresight to turn potential risk into opportunity.

So stay sharp, stay enthusiastic, and most importantly, stay the course. Your journey through the real estate cycle is a testament to your acumen and tenacity, and as you navigate through hyper supply, you’re setting the stage for your next big win. The energy in the air is electric – it’s an investor’s market, and with your smart decisions, the next phase is just another opportunity to excel.

Market Cycle 04 – Recession Phase

The Impact of Recession on Real Estate

Here you are, at the brink of the recession phase, and the market’s energy has shifted. You can feel the cool wind of change as it whispers through the empty halls of those newly built, yet unoccupied, spaces. It’s time for reflection and, yes, action. The once-booming market is taking a breath and in doing so, is offering you a moment to reassess.

During this phase, the market slows down. Construction halts, as do the echoing hammers and the hum of machinery. Developers put their plans on ice, waiting for better days. It’s a cycle, after all, and the savvy investor in you knows this is a natural ebb. This is where being proactive sets you apart. Keep your eyes on the vacancy rates – they’re your canary in the coal mine, signaling the health of the real estate environment.

The recession phase sees property prices descend from their lofty heights. But you’re not the type to watch from the sidelines. You recognize opportunity amid the oversupply. This is a buyer’s market, and your expertise shines. You know that when others are fearful, it’s time to look for deals that others might overlook, properties with potential that can be snatched up at a discount.

Adapting to the Challenges of Recession

Taking on the recession means adapting, and you’re all about flexibility. You see the trajectory, and you’re adjusting your sails. You remember that the basics of real estate – location, quality, and demand – remain true. But now it’s also about tenacity and the shrewdness to find hidden gems in the market’s downtrends.

You cushion the impact by re-evaluating your portfolio, identifying which assets are sturdy enough to weather this phase and which might be better off released. You’re not just surviving; you’re strategically positioning for the upswing.

Networking is also critical now. The relationships you’ve built and continue to nurture can open doors to deals that aren’t even on the market yet. Stay in touch with brokers, lenders, and fellow investors. They’re your eyes and ears, and together, you’ll navigate these choppy waters.

And remember, recessions are not just challenges; they’re classrooms. With each cycle, you gain invaluable insights, learning more about the nuances of the market, the timing of investments, and the resilience required to prevail.

So take the lessons offered by each phase with gratitude. You’re not just passing through the cycle; you’re evolving with it. Amidst the drawback of this recession phase, keep that excitement alive. It’s the fuel that keeps you going, turning obstacles into stepping stones, ensuring that when the market inevitably rises again, you’ll be ready to ascend with it, fortified by the wisdom acquired during these quieter times. .

Strategies for Each Phase

Investment Approaches for the Real Estate Cycle

You’re on a thrill ride through the real estate cycle, each phase offering unique opportunities to grow your investment portfolio. Let’s talk strategy!

- Recovery – In the recovery phase, it’s your chance to buy. Properties are undervalued, and demand is beginning to flicker back like a flame in the wind. You’re picking up gems that others have overlooked, and your optimism is backed by solid data. You’re not just a buyer; you’re a visionary, seeing potential where others see problems.

- Expansion – Fast forward to the expansion phase, and you’re now watching your investment come to life. Occupancy rates are up, rents are climbing – you feel like the ringmaster of a flourishing market. This is where you may choose to develop new properties or enhance existing ones because the environment is ripe for growth, and you are primed to maximize value.

- Hyper Supply – As expansion slips into hyper supply – as you now know – it’s time to reassess. You’re taking inventory, ready to offload properties that have peaked and laser-focused on securing favorable lease agreements. You sense the tide is high, and you’re not about to be caught off guard when it turns.

- Recession – And when the inevitable downturn arrives, you’re not dismayed. Instead, you tighten up the ship. You’ve navigated these waters before, and while others may panic, you’re looking for distressed assets with the potential for high returns. The downturn isn’t a setback; it’s an invitation to invest wisely and prepare for the next cycle’s resurgence.

Timing the Market: Best Practices

Personally, I believe in Time in the Market vs Timing the Market. That said, it’s important to understand each phase and use it to help navigate different Market Cycles.

Timing the market may sound like an art form, and you’ve become quite the artist. You understand that success in real estate isn’t just about having capital; it’s about knowing when to strike and when to hold back. Your strategy shifts with the tides, and you’ve got this uncanny ability to anticipate market changes.

You’re not just watching numbers and trends; you’re interpreting them. Each economic report, each shift in policy, and every change in market sentiment is a clue that you weave into your investment tapestry. It’s about being proactive, not reactive – and you’ve mastered that proactive stance.

You’ve also learned the importance of liquidity during all market phases. You keep enough dry powder to take advantage of unexpected opportunities and to secure your current investments against unforeseen headwinds.

Through each season of the real estate cycle, you remain undaunted. Your excitement doesn’t waver because for you, each phase of the cycle isn’t just a series of ups and downs – it’s a carousel of opportunity, and with each complete turn, you’re notching up successes and gathering stories of how you turned challenges into victories. Riding the market’s ebb and flow, you make it look like a dance – a dance where you’re always one step ahead.

Real Estate Cycle and the Economy

Link Between Real Estate Cycles and the Broader Economy

Weave your way through the fabric of economic trends, and you’ll notice that the real estate market isn’t just a standalone giant; it’s undeniably intertwined with the broader economy. Take notice, because here lies your opportunity to forecast, not just the property world, but the economic landscape at large.

- Recovery – Imagine, during the recovery phase, the wider economy is often shaking off the dust of a downturn. It’s during this time when your acumen for sniffing out those undervalued properties really makes a difference. As the economic engine starts to rumble, you’re already seated in the driver’s seat with the map laid out in front of you. Buckle up! You’re pioneering the journey into economic and real estate prosperity.

- Expansion – Now, as the economic boom hits, so does the real estate expansion phase. Jobs are created, salaries rise, and there you are, perfectly positioned with your investments to reap the benefits. Your real estate investments mirror the vigor of the healthy economy, and the synchrony is exhilarating!

- Hyper Supply – Roll into the hyper-supply phase, and while the economy might show signs of overheating, you’re cool as a cucumber. You’ve forecasted this, you’ve planned for this, and you’re maneuvering your investment portfolio with the dexterity of a chess grandmaster. While others might overextend, you’re moving strategically, ensuring that your investments are sound and secure.

- Recession – And when the economic tides retract, so comes the real estate recession. But for you, it’s not a time of retreat; it’s time to shine with wisdom. You’re one of the stalwart investors who understands cyclical patterns, and with this downturn comes your chance to snap up the choicest assets while the less prepared are looking the other way.

Predictive Signals from the Real Estate Market

You’ve become adept at reading the market’s signals like an enigmatic book of secrets. But there’s no sorcery here – it’s a cocktail of knowledge and intuition. Like an elite athlete predicting the ball’s trajectory before it’s even been thrown, you see the patterns in real estate that forecast economic trends.

Every uptick in rental demands, every whisper of zoning law changes, and every palpable shift in consumer confidence – these are your tea leaves. By interpreting these signals, you don’t just gauge where the real estate market is heading; you get a vivid picture of the potential shifts in the economy as well.

Remember, your expertise in plyometrically jumping between market phases doesn’t just serve you; it serves as a beacon to peers and partners alike. Through your vigilant eye and strategic moves, you’re demonstrating the power of riding the real estate cycle, and in turn, showcasing your extraordinary acumen in synchrony with the ever-dancing economy.

Your enthusiasm isn’t contained by the highs and lows; it’s perpetuated by them. For in these cycles lies the heartbeat of your investment passion, a rhythm that beats synchronously with the very cadence of the economic pulse. Keep your eyes peeled and your senses sharp. Your next opportunity is cresting on the horizon, ready for you to seize it with gusto and finesse!

Conclusion: Staying Ahead of the Curve

Summarizing the Continuous Wave Pattern of Real Estate

You’re on this roller coaster of real estate, and mastery of the cycle’s rhythm is your golden ticket. It’s this continuous wave – recovery, expansion, hyper-supply, recession – that keeps the game exhilarating. You breathe in sync with the market’s pulse, don’t you? The ebbs and flows feel less like uncertainties and more like the familiar steps of a well-choreographed dance. How thrilling it is to be so in tune!

In recovery, keep your optimism fueled; this is the silent prelude to grand opportunities. As the market blooms into expansion, ride the wave with unbridled enthusiasm, for your investments are about to bear luscious fruit. Your keen eye isn’t fooled by the excess of hyper-supply; you’re too jubilant, celebrating the foresight that keeps you buoyant. And when the market contracts into a recession, that’s your cue, isn’t it? Time to play the market maestro, orchestrating deals with the precision of a virtuoso.

Clap your hands to the beat of this cycle; feel it vibrate through every investment decision. Why? Because this wave you’re riding reads like a storybook adventure, and you, my friend, are writing yourself as the hero.

Practical Tips for Real Estate Investors

Still buzzing from that jolt of knowledge about cyclical trends? You should be! Fly into this arena with your mind as sharp as a tack and with gusto akin to a heralded explorer. Now, let’s talk action – how can you use this thrilling adventure to your advantage?

First, foster an eagle’s eye for market indicators: vacancy rates, job growth, and construction levels. These are your crystal balls giving glimpses into future market phases. Strap in for some networking, too; staying connected opens doors to whispers of the next hot property or looming downturn. It’s not just what you know, it’s who you know that puts wind in your sails.

Diversify, oh daring investor! Spread your treasures across different property types and markets. You’ll stand unwavering when the tides shift, backed by a flotilla of diverse assets. And let’s not forget the importance of liquidity – have a treasure chest ready to plunder opportunities as they arise, even at the unexpected turns.

And always, always remember: adaptability is your superpower. Embrace it with open arms and a fierce heart. The market’s constantly changing, so why shouldn’t you? Transformations are not to be feared when you’ve got the map to the cycle, the compass of knowledge, and the ship of adaptability at your helm.

So, go ahead – use your spirited investment savvy to keep ahead of the curve. The real estate cycle waits for no one, but for an investor like you? It might just pause to give a standing ovation.